(855) 584-3576

Can I Sue for Damages in a Solar Panel Lawsuit?

One of the most frequently asked questions we receive from homeowners dealing with problematic solar panel installations is: "Can I sue for damages?" If your home has suffered damage due to a faulty solar panel installation—such as roof leaks, interior water damage, or electrical issues—you may be wondering if legal action can help recover those costs. The answer depends on who you’re suing and the nature of your case.

Understanding the Legal Limitations in Solar Panel Lawsuits

When pursuing legal action against your solar panel lender, the scope of recoverable damages is somewhat limited. Under the FTC Holder Rule, which protects consumers in financed transactions, you can sue your lender for damages—but only up to the amount of money you've already paid into the loan, plus the total loan balance.

This means that if you've suffered additional damages, such as roof leaks leading to mold damage or electrical failures causing appliance malfunctions, those expenses might not be fully recoverable through your lawsuit against the lender. Instead, the primary legal remedy is to eliminate or reduce your loan obligation, effectively crediting you for the financial burden you’ve endured.

What If You Want More Than Just Loan Cancellation?

To seek damages beyond your loan balance, you would need to file a separate lawsuit against the solar panel seller or installer. This type of lawsuit could include claims for:

Breach of Contract – If the installer failed to meet the terms of the agreement.

Negligence – If their work caused physical damage to your home.

Fraudulent Misrepresentation – If they misled you about the system’s capabilities, performance, or installation process.

However, one major obstacle homeowners face is that many of these solar companies have gone out of business. If your solar installer is no longer in operation, suing them may not be a viable option, as there would be no entity to recover damages from.

How Can a Lawsuit Against the Lender Help You?

While suing the lender may not provide direct compensation for home repairs, it can eliminate your financial obligation for a defective or misrepresented solar system. This can free up the funds you would have otherwise used to continue making payments on a faulty system, allowing you to invest in necessary repairs.

When filing a legal claim against your lender, you may be able to seek:

Cancellation of your solar loan

Refunds of previous payments made toward the loan

Compensation for damages—up to the amount of the loan balance

Rectification of negative credit reporting

What Should You Do Next?

If you believe you have a case against your lender due to a misrepresented or defective solar panel system, it's important to act quickly. The longer you wait, the more difficult it can be to gather evidence and build a strong claim.

Steps to Take:

Gather Your Documentation – Collect your contract, installation records, loan statements, and any communications with the solar company.

Document Any Damage – Take photos and keep records of any home damage caused by the solar panels.

Consult with a Solar Litigation Attorney – A specialized attorney can evaluate your case and guide you on the best legal strategy.

Final Thoughts

While suing for direct damages may not always be an option in solar panel lawsuits against lenders, eliminating or reducing your loan obligation can be a significant financial relief. If you have experienced misleading sales practices, defective installation, or a non-functioning solar system, you may have legal grounds to fight back.

(855) 584-3576

Justice Made Affordable and Accessible

The Law Firm Solely Focused on Solar Panel Lawsuits

Neal Prevost, Trial Attorney With 31 Years of Experience

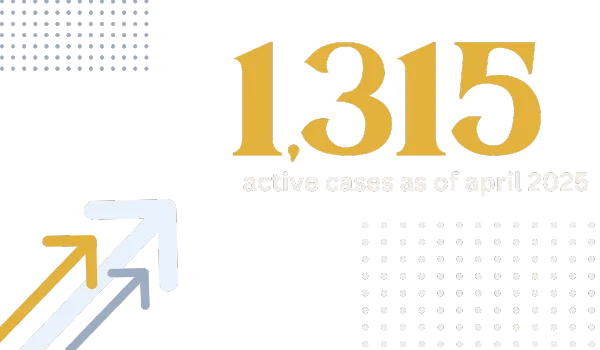

Our Results

What clients are saying

"Took Care of Everything"

I felt completely stuck when Encor went out of business, leaving me with an unfinished solar system that didn’t work, failed inspections, and a loan I still had to pay. On top of that, they misled me about tax credits and savings, and I ended up paying more in taxes and insurance instead. Prevost Law Firm stepped in and took care of everything. Their team handled my case with professionalism and compassion, and I’m so grateful for the outcome. If you're struggling with solar issues, you need to call them. (Cara J.)

"Exceeded My Expectations"

My experience with Encor Solar was a disaster. They installed a system that didn’t work, used an unlicensed subcontractor, voided my roof warranty, and lied about the need for batteries during power outages. When they went out of business, they left me with an unfinished system and no way to fix the mess they created. Prevost Law Firm was amazing—taking on my case and delivering results that exceeded my expectations. They are true advocates for homeowners, and I’m so grateful for their help. If you're facing a similar situation, I can’t recommend them enough! (John S.)

"Pleasure To Work With"

Would recommend 100%. Neal and his staff did an excellent job keeping me informed about the process every step of the way. He was able to get a settlement. He was a pleasure to deal with. (Gabrielle S.)

"Communicated Each Stage Clearly"

Working directly with Mr. Prevost was excellent. Having worked with several attorneys in several fields regarding general real estate matters, I was very pleased with my specific niche case against UCC-1 filings regarding solar liens. Mr. Prevost knew exactly how things would play out in handling the matter and communicated each stage clearly with me as to what I should do and what his team would need from me in the process. (Cody McDonald)

"Changed Our Lives

We can’t thank Prevost Law Firm enough for what they’ve done for us. My wife and I felt utterly defeated and trapped by the $73,590 loan for a solar panel system that never even worked. Encor, the installer, went out of business before the system passed inspection, but Solar Mosaic still demanded we pay for it. As disabled homeowners, we felt taken advantage of and didn’t know where to turn.

From the first phone call, their team made us feel like we weren’t alone in this fight. They listened to our story, fought tirelessly on our behalf, and never gave up until they got results. Thanks to them, our $73,590 loan was completely canceled, and we were refunded every single dollar of the $28,493 we had already paid into the loan. Best of all, we got to keep the solar panels for free!

When we got the news, we were overwhelmed with relief and gratitude. My stroke has already made life challenging enough, and this financial nightmare had only added more stress. Now, thanks to Prevost Law Firm, we can breathe again and finally focus on getting the panels working for us.

To anyone dealing with a solar panel loan disaster: don’t wait—call Prevost Law Firm. They are incredible, and they truly fight for people like us. We are so grateful we found them, and we hope others in similar situations will reach out for their help.

Bart and Diana Daniels

Feeling Lied To About Solar?

Millions of Americans have been duped into one-sided solar contracts. If you were misled when purchasing solar panels, you are not alone.

Is your solar contract costing you more money that it’s saving you? Did the solar salesperson misrepresent the savings or outright lie to get you sign up? Did you lose your warranty?

Our lawyers can help get you get justice.

No Cost

Claim-Review

As the nation's leading authority on solar panel legal matters, we have successfully helped numerous clients find relief from burdensome contracts.

Complete the form for a no cost case review and see how we can help you resolve your solar panel issues and regain peace of mind.

SOLAR LOAN CANCELATION

No-Cost Claim Review

Step 1 of 2

PO Box 6342 Mckinney, TX 75071

© 2024 Prevost Law Firm PC - ALL RIGHTS RESERVED | PRIVACY POLICY

Nothing herein is intended, and does not, create an attorney client relationship and is for informational purposes only. The Prevost law firm is licensed in Texas and is licensed to practice law in all Texas state courts and in multiple Federal Courts and Arbitration in 46 states. Solar sales are governed by both state and federal law. The attorney client relationship will only be created after the parties enter into a signed letter of representation.